DETROIT (WXYZ) — President Biden’s decision to address the nation's student debt crisis by canceling $10,000 in federal student loan debt is news that impacts many in Michigan.

1.4 million people in Michigan have student loans.

Some people impacted are voicing relief. Some who don’t benefit personally say it is unfair - and they are concerned it will lead to inflation.

When you adjust for inflation, the Michigan Association of State Universities says, in 2002 the state invested $2.35 billion.

Compare that to 2021 and that number is much less - at $1.47 billion.

These are just two shocking numbers we found as we took an in depth look at the student loan crisis now causing division.

If you make less than $125,000 and have federal student loans, President Joe Biden announced this week the government will forgive $10,000 in debt.

People who don’t currently owe student loan debt are divided over it.

"I am happy for others because I didn’t go through college and accrue debt during a time of inflation," said Andrea Pietrowsky, supports loan forgiveness.

"It’s bad. It feels unfair? Yes," said Larry Sobolewski, against loan forgiveness.

"Most responsible people in the world - you know you make loans, you pay it back," said Kevin Coleman, against loan forgiveness.

"The interest will kill you," said Jessica Hamzik, benefiting from loan forgiveness.

Jessica Hamzik used $32,500 in student loans to get a bachelors degree in accounting at Oakland University.

Her loan grew over four years by $8,000 because the federal government charged, at times, high interest.

Student loan debt consumes her income to the point where the accountant can’t afford to move out of her parents home.

"I want the ability to move out if I want to, and I don’t have that until now," Hamzik said.

"We need to get out of this business of if it is not benefiting me I don’t want any part of it. That is not how democracy works," said Andre Perry, Senior Fellow, Brookings Institution.

He says we as a society need to understand the problem that led to this.

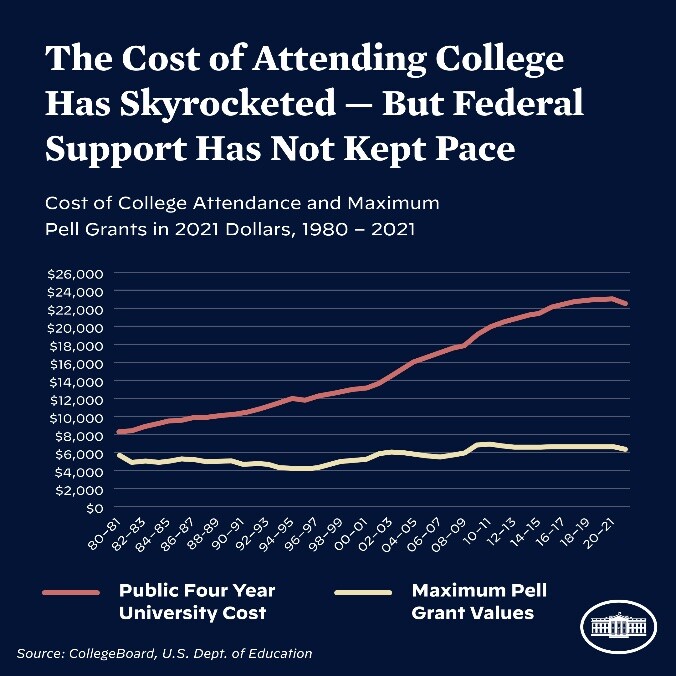

This chart shows how tuition increases have dramatically outpaced increases in income.

"It is providing relief to a segment of the population that can’t seem to catch a break. However, it doesn’t solve the root problem of rising tuition," said Pietrowsky.

Perry has heard concerns about government spending leading to inflation. He says this spending is in response to tuition inflation.

He suggests we talk about solutions - such as accountability for colleges as they set rates.

"We got to this point largely as a result of the state absolving its responsibility," said Dan Hurley, CEO of Michigan Association of State Universities.

Hurley says we also need to hold lawmakers accountable for a change.

In 1980, he says the state covered about 80% of general operations of state universities and student tuition covered 20%.

"Right now, that equation is completely flipped. The state is only paying about 20%. Students and families, often through loans are paying 80%," Hurley revealed.

Jessica Hamzik says she has felt the burden that's put on students. She hopes others don’t have to feel it.

"Obviously, it is a political thing and I get it, but for people like me for who there literally was $10,000 sitting between me and my future, take that into consideration," Hamzik said about the impact of student loan forgiveness for borrowers buried in debt.

If you are impacted by student loan forgiveness and want to know what you need to do next, click this link to learn more.